A study on supply chain management of pharmaceutical industry.pdf

Table of Contents

General Industry analysis

Key players in pharmaceutical industry are

Product channel

Value chain of pharmaceutical industry

Advantage in India for pharmaceuticals

Structure of pharma sector in India

Revenue by Indian pharma

Current trends in pharmaceutical industry

Strategies by pharmaceutical industries

Growth drivers

Future opportunities in pharma

Supply chain analysis for the industry

Glenmark

- Introduction

- Primary business:

- Competitive strategy

- Demand and supply analysis

- Supply chain strategy

- Supply chain design, planning and operation

- Facilities

- Inventory

- Transportation and logistics

- Information

- Sourcing and procurement

- Distribution network

- Supply chain performance analysis

- Benchmarking with financial data

Glenmark

Torrent pharma

- Introduction

- Competitive strategy

- Demand and supply analysis

- Supply chain strategy

- Supply chain design, planning and operation

- Facilities

- Inventory

- Transportation and logistics

- Information

- Sourcing and procurement

- Distribution network

- Supply chain performance analysis

- Benchmarking with financial data

Torrent Pharma

SC challenges

Comparative analysis of industry and study companies

Financial ratios

Supply chain ratios

SCOR model

SWOT

Key observations and recommendations

Conclusion

References

General Industry analysis

India is the largest supplier of generic medicines worldwide. Its cost of production is almost half compared to Europe and US; therefore, India enjoys a huge competitive edge. By 2020, India will become the 6th largest market for pharmaceuticals globally.

The pharmaceutical industry can be characterized as a complex of processes, development and manufacture of operations and organizations engaged in the discovery, medications and drugs.

Key players in pharmaceutical industry are

- Contract manufacturers, who does not have any brand, but rather they produce active ingredients needed for finished product

- Local manufacturing companies

- Organizations which are worldwide available and R and D along with a brand name are manufacturing available in different locations.

- Generic makers

- New startups, biotechnology organizations.

Normally pharmaceutical industry does Research and development on specific type of health problems, they get license on their formula, these licenses can create a huge barrier for new companies so there will less chance for substitution.

Product channel

- Discovery (two to ten years)

- Launch (approval by concerned authority)

- Commercial (marketing and post testing)

- Clinical trials with various stages and phases (testing on volunteers to determine dosages and side effects)

- Preclinical trials (laboratory and animal testing)

Value chain of pharmaceutical industry

- Invention of the particles for the specific disease

- Complying with complex regulation process by government and industry

- Various methods for security of the items

- Manufacturing of the product

- Primary manufacturing of the active ingredients (AI) in plants

- Secondary manufacturing is the production of the final product in plants

- Based on the tax levied from location to location, manufacturing plant is selected

- Product’s packing

- Distribution

- Logistics and transportation mode to reach all the places

- Sometimes transport is outsourced to third parties and health authorities

- Retail

- Hospitals

- Doctors

- Outlets of the drugs and pharmacies

Advantage in India for pharmaceuticals

- Cost efficiency

- Low cost of productions because of effective R and D

- India is destination of medical tourism

- Cost of production is also one third lesser than western market

- Produce high quality and low-priced medicine (efficient use of resources)

- Government policies

- Government vision of making India a global leader in end to end drug manufacturing by 2020.

- East acceptability for new facilities and ideas.

- 100% foreign direct investment is allowed.

- India is destination of medical tourism

- Less taxes on pharma

- India is destination of medical tourism

- Drivers

- People’s affordability

- Health insurance is increasing

- Rural market attracted by readily available drugs

- Portfolio is diverse

- India global manufacture (10%)

- Has more than 60000 generic brands

- More than half of Drug master filing(DMF) in US is from India

Structure of pharma sector in India

Important Segments in Indian Pharmaceutical Sector

- Active Pharmaceutical Ingredients (APIs)

- Formulations

- Biosimilars

- Contract Research and Manufacturing Services (CRAMS)

- Indian Pharmaceutical sector divides into three parts; Generic drugs, OTC medicines and Patented drugs. Among these Generic drugs contribute highest in revenue generation (70%). Patent protection not last forever, this could be the reason behind lesser market share.

- In recent years a number of patents on big selling products from global pharmaceutical companies have come to an end, and more are set to do so over the next few years. This is forcing big pharma firms to look for new revenue streams, and it is having an impact on the overall shape of the market.

Revenue by Indian pharma

- As we can from the graph the India Pharmaceutical sector is showing small increment year by year.

- It is expected to reach at 55% till FY2020. The reason behind it could be The Government of India implemented ‘Pharma Vision 2020’ aimed at making India a global leader in end-to-end drug manufacture. Due to this the approval time for new facilities has been reduced to boost investments.

- Moreover, the Government of India is planning to set up an electronic platform to regulate online pharmacies under a new policy. This will lead to decrease the misuse due to easy availability.

- As shown in the graph the share of patented and generic drugs in prescribed drug market is increasing year by year. Generic drugs contributing more in market.

- This is because the process for approving a generic drug is generally faster than it is for new medications. Instead of submitting a new drug application to the FDA, companies can submit an abbreviated version of the form, called an ANDA. Moreover, US is approving more generic drugs. Whereas on the other hand Patented protection is not last forever.

India exports more pharmaceutical drugs, as we can see in graph the export is increasing yearly. Whereas, the import has been decreased after FY14.

It shows India Pharmaceutical companies are best utilizing and framing strong forecast strategies for export business. It is necessary to understand that the common inspection, filing procedures accepted among regions may help the industry in faster growth. Complex supply chain in Indian pharma sector. Customer service level is comparatively low in Indian pharmaceutical industry. Both as shown in figure below.

Current trends in pharmaceutical industry

- R and D– Indian pharmaceutical spending in R and D is 8 to 13%, driven by increase in product license

- Export- Quality is major factor Indian manufactured medicines are known for, Indian pharma accounts for worth of 16.64 billion US dollar exports

- Joint ventures – MNC are collaborating with India to develop the drugs. “LAZOR” is the alliance formed by six pharma companies to share best practice and improve efficiency with low operating costs.

- PPP in R&D- multi-billion-dollar investment invited by Indian Government with 50 per cent public funding through its public private partnership (PPP)

- Draft Patents (Amendment) Rules, 2015- has reduced the licensing procedure to 4 months from 12 months.

- Less time for approval– approval process of drugs has been less time for approval simplified by the authorities and time has been reduced for approval of new facilities.

Strategies by pharmaceutical industries

- Mergers and acquisitions

- Vertical integration to achieve cost leadership

- Expanding their operations.

- More focus on new markets (oncology, dermatology)

Growth drivers

- Supply side

- Skilled labor

- Cost advantage

- Medical infrastructure is strong in India

- India is major manufacture in pharma

- Increase in patented compounds.

- Increase in over the counter drugs (OTC)

- Demand side

- Ineffective lifestyle leads to increase in diseases.

- Increase in health insurances.

- Acceptability of pharmaceuticals

- Epidemiological factors

- More diagnostic facilities.

- Affordability of people

- India’s cost of production is nearly 33 per cent lower than that of the US.

- Labour costs are 50–55 per cent cheaper than in Western countries. The cost of setting up a production plant in India is 40 per cent lower than in Western countries

- India has chap labour and high managerial and technical competence in emerging markets. Therefore, cost-efficiency continues to create opportunities for Indian companies in emerging markets.

Future opportunities in pharma

- Intellectual property protection

- Manufacturing of high end drugs

- Penetration in rural markets

Supply chain analysis for the industry

Glenmark

Introduction

Glenmark Pharmaceuticals Limited (Glenmark) is a leading pharmaceutical company headquartered in Mumbai, India. The company was incorporated in 1977 by Gracias Saldanha. Glenmark manufactures and markets generic formulation products and active pharmaceutical ingredients (API), domestically and globally. In the planned business, its business includes Internal Medicine, Dermatology, Paediatrics, Gynaecology, ENT and Diabetes.

The company produces and offers finished branded products, generic drugs and active pharmaceutical ingredients (APIs) in 80+ countries including India, EU, United States, Japan and South America.

Glenmark was ranked among the world’s top 80 pharma and biotech companies, as per SCRIP 100 Rankings (2014).

With portfolio of 90+ products in niche segments like hormones, oncology, controlled substances, dermatology, and modified release products, the company’s US subsidiary (Glenmark Generics Inc.) is one of the Top 25 generic drug companies in the US.

Primary business:

- Its structured surrounded drug discovery, branded formulations, generics formulations and active pharmaceutical ingredients (APIs)

- It covers areas such as dermatology, internal medicine, gynecology, anti-allergics, anti-infectives, antibiotics, paediatrics, cardiovascular, anti-emetics, ENT, diabetes, etc.

Competitive strategy

- Better generic formulation

- Branded formulations

- Drug discoveries

- High API’s (Active pharmaceutical ingredient)

| YEAR | ACTIVITES OF GLENMARK |

| 2017 | IT REPORTHED THAT IN INDIA, US, EU AND API TO CONTRIBUTE >80% TO THE OVERALL REVENUES |

| 2016 | GLENMARK AS FIRST PHARMA COMPANY TO LAUNCH A TREATMENT FOR HIGH COLESTEROL |

| 2015 | THEY GOT LICENSING AND STRATEGIC DEVELOPMENT AGREMMENT WITH CELON, POLAMD FOR GENERICSERETIDE IN EUROPE AND ALSO GORT APPROVALS IN RUSSIAGLENMARK WAS CONFERRED WITH THE PHARMAEXCIL GOLD AWARD FOR NEW CHEMICAL ENTITIES 2015 |

| 2014 | A NEW MANUFACTURING FACILITY IN NORTH CAROLINA, US FOR DEVELOPMENTA NEW ANTI-BODY MANUFACTURING FACILITY IN SWITZERLAND |

| 2011 | · SCRIP crowns Glenmark as the “Best Pharma Company in Emerging markets” and “Best Overall Pipline” at SCRIP Awards |

| 2006 | THEY STARTED R&D IN NOVEL BILOGICAL ENTITY IN 2006 THEY ACHIVED LICENCING OF FIRST NOVEL BILOGICAL ENTITY FOR GBR 500 |

| 2005 | THEY LAUNCHED FRONT END COMMENRCIAL SALES IN US.TO SUPPROT US OPPERATIONS THEY SETUP STARTED IN GOA, INDIA |

| 2004 | THEY GOT FIRST LISENSEING DEAL WITH FOREST LABORITIES |

| 2001 | THEY SETUP ACTIVE PHRMACETICALS INGREDIENT MANUFACTURING IN MAHARASTTA AND GUJARATH, INDIA |

| 2000 | GLRNMARK WAS LISTED IN BOMBAY STOCK EXCHANGE |

Demand and supply analysis

Supply chain strategy

Glenmark focus is on expanding their operations across all aspects of their business (API manufacturing and pure generics businesses, the branded generics business)

More focus on expansion plans in overseas market by developing capabilities in the implementation and ignoring the low-cost.

Capitalize on partnering opportunities- partnership without licensing in diseases, pain and inflammation therapeutic areas. develop promising molecules up to the early clinical stage and then out-license to international companies.

Keep on investing in disclosure research and focuses in the regions of diabetes, digestion, aggravation, torment and oncology.

Spotlight on higher-development helpful fragments in the marked generics advertise, it is the key, development markets for business.

After doing proper research launching the product in the relevant markets, supplemented by in-authorized items as they are important to reinforce the item suite.

To maintain the market position by building on brand equity form the reputation with some established players in particular segment and maintain good relationship with medical professionals in India.

Supply chain is push type and employs make to stock method.

Supply chain design, planning and operation

Facilities

- 18 manufacturing plants (8 USFDA approved)

- 5 API plants in India for captive and commercial requirements

- 6 R&D centers

- 1 GMP-grade biologics manufacturing plant in Switzerland

- 12 finished dosage plants in 6 countries

- 20 offices worldwide

Inventory

Inventories of finished goods, consumable store and spares are valued at cost or net realisable value, whichever is lower. Cost of raw materials and packing materials is ascertained on a weighted average cost basis. Cost of work-in-process and finished goods include the cost of materials consumed, labour and manufacturing overheads. Excise and customs duty accrued on production or import of goods, as applicable, is included in the valuation of inventories. Net realisable value is the estimated selling price in the ordinary course of business, less the estimated costs of completion and selling expenses. The factors that the Group considers in determining the allowance for slow moving, obsolete and other non-saleable inventory includes estimated shelf life, planned product discontinuances, price changes, ageing of inventory and introduction of competitive new products, to the extent each of these factors impact the Group’s business and markets. The Group considers all these factors and adjusts the inventory provision to reflect its actual experience on a periodic basis. Inventories of finished goods, consumable store and spares are valued at cost or net realisable value, whichever is lower. Cost of raw materials and packing materials is ascertained on a weighted average cost basis. Cost of work-inprocess and finished goods include the cost of materials consumed, labour and manufacturing overheads. Excise and customs duty accrued on production or import of goods, as applicable, is included in the valuation of inventories. Net realisable value is the estimated selling price in the ordinary course of business, less the estimated costs of completion and selling expenses. The Company considers several factors in determining the allowance for slow moving, obsolete and other non-saleable inventory including estimated shelf life, planned product discontinuances, price changes, ageing.

Transportation and logistics

The role of transportation, storage, and distribution is to store and move goods with integrity and to deal with the associated issues of local, national, and international trade and commerce. The responsibility set is highly specialized and focused on transferring and maintaining the invested value between two defined locations. It is not intended that any value-adding activity occur. The starting point is to define the goods to be transported and/or stored in as much detail as will satisfy customers and all the various national and international competent authorities involved. Whatever paperwork or documentation required must be raised, checked for accuracy, and monitored through the passage. The entire physical transfer process and receipt by the customer must be tracked closely and confirmation of successful outcomes achieved.

Information

Glenmark had implemented SAP for automating their business operations. Their purchase process was fairly complex with multiple purchase scenarios and multiple actors. All these purchase workflows were configured in SAP. But there were delays in execution of purchase workflows as the approvers of purchase decisions were mobile. This led to delayed purchases which had an impact in supply planing and supply chain management. The problem was common across 14manufacturing locations that they were operating. Orient Technologies provided a mobility solution called Quikformz as a solution to Glenmark. QuikFormz is a platform for quickly developing and deploying customised mobility solutionfor an enterprise across multiple mobile platforms and OS. Orient’s Quikformz was able to provide a tool to the mobile purchase decision makers to provide approvals / rejections of Purchase Orders on their mobile . This workflow gets originated in SAP and is updated back to SAP.

Sourcing and procurement

Raw Materials in Glenmark are being procured at the existing 4 manufacturing locations across the globe. Glenmark holds a strategy of Acquisition of smaller companies producing the raw material. This raw material is generally segregated into two categories: A) GDPRM (Generic Drug Production Raw Material) B) MPRM (Molecule Production Raw Material). It is very important for companies in pharmaceutical sector that how purchase, manufacturing and planning need to work seamlessly for effective market catering and for the overall company objective. According to the issue of complexity, there are typically two parts in the company’s Supply chain planning and coordination to dealing with it: The first is called Master Planning of Resources and the second is called Scheduling. In Glenmark this handled by ERP package such as SAP. The output from such a system is a firm plan and also material requisitions which are forwarded to the procurement team, along with the expected delivery dates, considering the testing times. The next step is Scheduling, which is active when that particular month is reached. So, while Master Planning of resources enables the Planner to look at the long- term and broader picture, scheduling is the immediate future and at a more micro level. Other key inputs will be the recipe (called formulation or BOM), product routing, i.e. how each product moves and how much time is taken for processing at each stage and alternate recipes, as applicable. So, the need for ERP and other Software applications to approach this level of data and analysis arises.

Distribution network

The wholesale distributors play a vital role in the day-to-day functioning of the pharmaceutical supply chain for volumes handled by distributors. In addition to facilitating the movement of products between manufacturers and customers in a safe, reliable and efficient manner, the distributors also provide numerous services, such as extension of credit and receivables management. Glenmark Pharmaceuticals is currently in the process of revamping its distribution set-up from the conventional three-tier structure to a two-tier one. With this change the company now makes supplies directly to stockists, who in turn make supplies Some prominent features of the environment that have a direct impact on the distributors are:

- Strict government regulations

- Large number of proprietary manufacturers

- Large and diverse customer base

- Extremely fast ramp up and ramp down of demand

- Very short turnaround time

- Special handling requirements

- Diverse product lines

Supply chain performance analysis

Benchmarking with financial data

| Glenmark | Amount in crores | |||

| Year | 2017 | 2016 | 2015 | 2014 |

| Cost of raw Materials | 23,548.13 | 19,287.47 | 18,248.42 | 14,319.78 |

| Cost of production | 84,475.46 | 52,095.49 | 45,108.7 | 47,274.89 |

| cost of distribution | 2,185.76 | 2,052.37 | 1,995.06 | 1,752.80 |

| cost of sales | 8,425.27 | 6580.92 | 4648.35 | 2839.08 |

| net sales | 9,223.05 | 7,662.00 | 6,650.22 | 6,010.04 |

| Total Inventory (RM+FG+WIP) | 21390.5 | 15677.6 | 12690.39 | 12690.39 |

| Raw Material | 6577.25 | 5562.23 | 4131.97 | 4131.97 |

| Semi-finished goods inventory | 3431.75 | 2753.08 | 2276.95 | 1,977.89 |

| finished goods inventory | 11381.5 | 7362.29 | 6281.47 | 6580.53 |

| Accounts receivables | 2,404.32 | 2,492.65 | 2,511.77 | 2,156.34 |

| Accounts payables | 1,903.52 | 2,006.58 | 2,045.67 | 1,362.58 |

| total assets | 11763.87 | 11,102.64 | 9,687.51 | 8,633.60 |

| Supply Chain Length (DRM+DFG+DWIP) | 609.8462848 | 532.8872661 | 594.3072924 | 966.6027704 |

| DRM | 101.9484881 | 105.2607703 | 82.64655515 | 105.3206858 |

| DWIP | 14.82784172 | 19.28908241 | 18.42409412 | 15.27089434 |

| DFG | 493.069955 | 408.3374133 | 493.2366431 | 846.0111902 |

| Supply Chain Cost | 6483.242 | 5202.296 | 4545.052 | 4301.86 |

| Supply Chain inefficiency ratio | 0.702939049 | 0.678973636 | 0.683443856 | 0.71577893 |

| Supply chain working capital productivity | 0.421311206 | 0.47402601 | 0.505470684 | 0.445711446 |

| Supply chain working capital | 21,891.30 | 16,163.67 | 13,156.49 | 13,484.15 |

| Return on Assets % | 15.28 | 14.31 | 13.16 | 10.25 |

| Asset Turnover Ratio (%) | 57.82 | 59.59 | 66.47 | 54.4 |

| Fixed Assets | 3.62 | 3.17 | 4.3 | 4.38 |

| Inventory | 2.33 | 2.26 | 2.96 | 2.88 |

- Days of raw materials is having variations so there might be in efficient forecast

- Days of work in progress is looking to be stable so from days of production to manufacture products are well maintained

- Days of finished goods is decreasing so it is good as Time taken to sell the products it manufactures is reduced

- Inventory turnover is number of times inventory is sold or used in a time period such as a year here it is stable with not much variation

- supply chain length is having downward trend, so performance is good

- Supply Chain inefficiency ratio has increased so the supply chain cost increases

- Supply chain working capital productivity rise as liabilities decreased

- Supply chain working capital increased as liabilities decreased

- Return on asset is percentage of profit a company earns in relation to its overall resources, here it is increasing

- Asset turnover efficiency of a company’s use of its assets in generating sales revenue, in this case it is stable

Torrent pharma

Introduction

Torrent Pharma, the flagship company of Torrent Group, is poisoned among the top pharma companies of India. It is a leader in the therapeutic areas of cardiovascular (CV) and central nervous system (CNS) and has achieved significant presence in gastro-intestinal, diabetology, anti-infective and pain management segments.

It has also forayed into the therapeutic segments of nephrology and oncology while also likewise focus on gynecology and pediatric segments., Torrent Pharma has always remained ahead of its competition right from pioneering niche marketing in India to earning the sobriquet of ‘the Company with the most first launches’

Torrent Pharma enjoying its competitive advantage stems from its highly oriented manufacturing facilities, advanced technological and R&D capabilities. Its domestic market is too big and its globally spread.

It has three world-class manufacturing facilities at Indrad (Gujarat), Baddi (Himachal Pradesh) and Sikkim. The facilities are approved by USFDA, WHO, MHRA, TGA and other global regulatory bodies. For catering to the international market, they are developing a new facility at Dahej SEZ in Western India. Torrent Pharma is the only manufacturer of Insulin Formulations for Novo Nordisk in India since the early ‘90s. They have also set up a dedicated formulation and packaging facility for Insulin.

The company established in 1959 has annual turnover of over 4,700 crores is the leading company of the Torrent Group. The company’s 6 brands named among top 300 brand in India and it also ranked 15th (by turnover) in the domestic formulations market. It is also doing good in foreign market, presence over 40 countries with over 1200 product registrations, the company has healthy presence in US, UK, Germany, Brazil, Russia, Mexico, Philippines and other major markets.

Established in 1959, Torrent Pharma, with an annual turnover of over 4,700 crores is the flagship company of the Torrent Group. Torrent Pharma ranked 15th (by turnover) in the domestic formulations market with six of its brands among the top 300 brands in India. Strong international presence spanning over 40 countries with over 1200 product registrations, the company has healthy presence in US, UK, Germany, Brazil, Russia, Mexico, Philippines and other major markets.

Competitive strategy

- Conservation of energy

- Technology absorption (R and D)

- Strong product pipeline

- Manufacturing facility

- Good market reach

Demand and supply analysis

The demand planning is the process by which the company generates the forecast on the market demand of the particular product or products. Torrent, the supply chain management is very well conducted and due to this reason, the company is having a smooth flow of their products across different places. The demand planning is done on the four months rolling plan. By this rolling plan the company undergoes many procedures and they includes the demand forecasting, production planning, supply planning and dispatch planning. The demand plan is the first step and is done by the marketing department. After the review done by the demand planning cell is over, then the next step is financial planning which is followed by the dispatch planning and procurement planning is done accordingly. The system thus followed by the torrent pharma is by the usage specific statistical tools. The demand and supply analysis process is thus performed on the basis of statistics on the average sales, minimum and maximum sales and thus the orders are taken into consideration. Thus it is generally predicted and analysis is done on the basis of the post data available, that means the quantitative data is mainly being used by torrent. Some factors like the epidemics, seasonal effect and some of the visible factors like competitors move, market behavior and authoritarian factors too.

Supply chain strategy

- Acquisition to fuel its future growth

- Currently the company is seeing their path in expanding their business in both domestic as well as international market. The company had acquiring Elder’s branded formulation business and recently signed an agreement to take-over 100% stake in Zyg Pharma, a company engaged in manufacturing various dermatological formulations like creams, ointments, gels, lotions, and solutions.

- Torrent Pharma has strongly build their market domestically with focus and leadership in CVS (cardiovascular) and in CNS (central nervous system) segments.

- Torrent Pharma’s competitive advantage includes its brilliant manufacturing facilities, extensive domestic network advanced R&D capabilities, and a widespread global presence.

- Capitalizing on its market-leading presence in domestic formulation business

- As per All India Organization of Chemists and Druggists (AIOCD), Torrent Pharma leader in the market, with 27% growth in domestic manufacturing business as compared to covered market growth of 16% during Q4FY15. Whereas Indian Manufacturing segment accounts for 35% of company’s total sales, grew at CAGR of 17% in FY10-15.

- Company is doing continues efforts in strategic initiatives which may lead to further improve its market share through re-alignment of business units to bring in higher focus on key customer segments.

- The company is well poised to grab the shifting chronic market as the company is doing god in chronic segment as company is from chronic segment as compared to 27% of IPM (Indian Pharmaceuticals market),

- The company is to focus on its core business and strategic priorities to improve its productivity through brand building in major therapies expanding portfolio in newly entered segments and accelerating performance in the acute segment.

Supply chain design, planning and operation

Facilities

Torrent Pharmaceuticals has the most integrated operations encompassing basic pharma substances, intermediates, bulk drugs and dosage forms.

- Tablet facility: Modernized / Upgraded to Meet International Standards.

- Department has following Hygiene Zones:

‘O’ Area – Products exposed to environment

‘E’ Area – Products in close containers

Entry from ‘E’ to ‘O’ area is restricted by separate gowning procedure.

- Area-wise personnel and material movement through separate air lock.

- All manufacturing area has 100% fresh air to avoid cross contamination.

- Equipment’s are

- Wet Granulation

- Dry Compaction / Granulation

- Pellet Coating

- Film Coating

- Enteric Coating

- Sugar Coating

- Bilayer Tablet

- Capsule Facility has

- Encapsulation

- Hard gelatin

- Pellet Filling

- Tablet Filling

- Combination of Powder/Pellet & Powder / Tablet Filling

- Soft Gelatin

- Parental Facility- Facility has been designed under technical guidance of M/s. Novo Nordisk, Denmark which complies International Regulations.

- Ampoule

- Freeze drying

- And area is divided in to red, green and blue region

- Packaging Facility consists of

- Aluminium – PVC / PVDC (Blister)

- Aluminium – Aluminium Foil (Strips)

- Aluminium – Aluminium (Cold forming)

- Bulk Packaging

- Pouch Packaging (triple laminated foil)

- Vials / Bottle Packgin

- And area of packing facility is designed as

- Primary Packaging (‘O’ Area) – 100% Exhaust

- Each machine in closed cubicle

- Connected to Dust Extraction System

- Controlled environment (low RH – selective)

- Secondary Packaging (‘E’ Area)

- Segregation of each packaging line

- Stringent checks and controls at final packaging

- Quality Control Facility consists of these equipment

- Active Pharmaceutical Ingredients Plant Facility

- As a backward integration to the Formulation Division, a separate API Plant located in premises having their own utility and raw material store facilities.

- API production plant is divided in two part, Technical plant and Pharma area. Technical plant is provided with once through filtered air while Pharma area is provided with once through filtered air-conditioned air.

- Technical Plant is equipped with SS and Glass Lined reactors having capacity 160 Lit. to 5000 Lit., SS and MS Rubber Lined Centrifuges, Tray dryer, Filters etc. There are separate Store Rooms (2 Nos.) for storage of Intermediates, out of which one is airconditioned.

- Pharma area is equipped with equipment for handling finished product like Tray Dryer, Air Jet Mill, Sifter, Blender, Multi Mill and packing area. Pharma Area is also having separate storage facilities to store materials at different stages.

- Engineering Services Facility

- The department works as a support function for the entire plant activity, including new project, formulation and API production, administration, environmental controls and ensures compliance of all statutory as well as regulatory directives.

The equipment and machines in this facility are

Inventory

Inventories are carried at the lower of cost and net realizable value. The cost incurred in bringing the inventory to their existing location and conditions are determined as follows:

- Raw material and packing material – Purchase cost of materials on a moving average basis.

- Finished goods (manufactured) and work in progress – Cost of purchase, conversion cost and other costs on a weighted average cost method.

- Finished Goods (traded) – Purchase cost on a moving average basis.

The cost of purchase of inventories comprise the purchase price, import duties and other taxes (other than those subsequently recovered by the company from taxing authorities) and transport, handling and other costs directly attributable to bringing the inventory to their existing location and conditions. Trade discounts, rebates and other similar items are deducted in determining the costs of purchase.

Net value is the estimated selling price in the ordinary course of business less the estimated costs of completion and the estimated costs necessary to make the sales. The Company considers various factors like shelf life, ageing of inventory, product discontinuation, price changes and any other factor which impact the company’s business in determining the allowance for obsolete, non-saleable and slow-moving inventories. The company considers the above factors and adjusts the inventory provision to reflect its actual experience on a periodic basis.

Raw materials storage

RM Stores has 100% controlled environment storage for active and inactive raw materials. Dispensing of raw material as per requirement

- Separate Areas like Receipt, Under Test and Approved raw materials.

- 3 Separate Sampling Booths with Reverse Laminar Air Flow System.

- 4 Dispensing Booths with Reverse Laminar Air Flow System

Packing Material Store

- Separate area for Receipt/ Under test and Approved Materials

- All packaging materials are stored as per cGMP(Current Good Manufacturing Practice) guidelines and procedures laid down in SOPs(Standard operating procedure).

- Maintaining controlled environment for primary packaging materials. Dispensing batch-wise as per SOPs.

Bonded Store Room (BSR)

- Formulations and API are kept in BSR in controlled environmental conditions.

- Facilities are also available for cold chain products

- The finished products are dispatched from BSR to Duty Paid Store for Domestic sales after compliance of Central Excise Duty formalities.

- Dispatches of finished goods to Cargo Handling Agents for Exports

Duty Paid Store (DP Store)

- Storage facility available for controlled condition and cold chain products.

- Promotional inputs dispatches to concerned Marketing Field Force.

Active Pharmaceutical Ingredients Store (API Store)

- Activities similar to raw materials stores of formulation plant are undertaken

- Caters to the requirements of API manufacturing facilities.

- Handles bulk storage of various chemicals, solvents and hazardous materials

- Facility available to store the RMs in controlled environment

- Utmost care, safety precautions to maintain better working conditions.

Information Technology (I.T.)

- Helps to maintain manufacturing and distribution activities.

- EIS and MIS reports generated for analysis and decision making

Transportation and logistics

The Company consciously activities to sources its procurement of the goods and services from medium and small vendors from the local areas where feasible. It improves operational efficiency and saves on transportation cost and inventory management. Further, the Company fulfills its manpower requirement by employing the people from the nearby location where it has its business operation to the possible extent. The Company provides detailed specifications as well as technical knowhow to improve capacity and capability of local and small vendors.

The Company follows sustainable sourcing, production and distribution practices ensuring quality and safety of raw materials, API, intermediates and packaging materials procured from suppliers as well as of products manufactured, stored and distributed throughout the value chain. The Company has laid down a robust process for vendor evaluation and selection mechanism and prefer local suppliers wherever possible. The Company also emphasis on safe transportation, optimization of logistics and reduction of vehicular air emissions.

Information

The Company is highly dependent on information technology systems and related infrastructure. Any breakdown, destruction or interruptions of this system could impact the day to day operations. There is also a risk of theft of information, reputational damage resulting from infiltration of a data center and data leakage of confidential information either internally or otherwise. The Company keeps on investing appropriately on the protection of data and information technology to reduce these risks.

Sourcing and procurement

Quality Control:

Torrent Pharma ensures a modern and well-equipped Quality Control (QC) laboratory, which ensures that the products are pure, safe and effective and are released only after thorough analysis as per stringent specifications, methods and procedures developed according to international guidelines viz. EU cGMP, MHRA, WHO, TGA, etc.

Supply Chain Working:

The company keeps raw and packaging materials with it in advance. When the order receipt comes they will verify it whether they can make the order or not. After verification order sampling is done according to what type of order is, then it will go under further tests.

Then Q.C. Testing is managed through four sections:

- Instrumental Analysis and Finished Products

- Wet Analysis Laboratory

- Microbiological Testing Laboratory

- Packaging Material -Testing Laboratory

The QC department performs following activities:

- RM/PM analysis

- Finished Products analysis

- In-process Checks

- Stability Studies

After Q.C. testing they will decide upon the acceptance or rejection of order. If reject, receipt would return to the supplier back, if approved, order will be given for further manufacturing process. After that further operations are being done and finally the product after manufacturing and packaging the product will be sent to the supplier.

http://www.torrentpharma.com/quality%20control.php

Distribution network

Torrent’s rank in terms of overall drugs, currently stands at 14th. Company will also be amongst the top 10 players in future by further consolidating and improving its specialist focus. The deal will increase the distribution reach Torrent Pharma with additional 2,000 stockists to its existing portfolio.

Unichem Acquisition will strengthen torrents distribution, the existing position will move to the 7th position.

Supply chain performance analysis

Benchmarking with financial data

| Torrent Pharma | in crores | ||||

| Year | 2017 | 2016 | 2015 | 2014 | 2013 |

| Cost of raw Materials | 1,176.40 | 1,040.97 | 973.51 | 878.02 | 844.81 |

| Cost of production | 3,505.96 | 2,846.97 | 3,477.71 | 2,962.09 | 2,614.11 |

| cost of distribution | 64.22 | 78.67 | 109.11 | 94.35 | 80.45 |

| cost of sales | 388.99 | 366.53 | 534.11 | 429.49 | 368.55 |

| net sales | 4,892.28 | 5,732.62 | 4,939.00 | 4,222.85 | 3,254.50 |

| 25.98 | |||||

| Total Inventory (RM+FG+WIP) | 1032.29 | 970.13 | 781.15 | 1067.11 | 923.86 |

| Raw Material | 595.2 | 543.99 | 405.37 | 405.88 | 376.97 |

| Semi-finished goods inventory | 137.79 | 153.45 | 135.75 | 135.75 | 122.89 |

| finished goods inventory | 299.3 | 272.69 | 240.03 | 525.48 | 424 |

| Accounts receivables | 1,018.47 | 911.5 | 1,194.00 | 1,594.54 | 687.82 |

| Accounts payables | 1090.51 | 1,339.52 | 1,088.48 | 2,831.03 | 1,709.58 |

| total assets | 8,080.51 | 9,013.59 | 7,911.08 | 5,069.81 | 3,782.85 |

| Supply Chain Length (DRM+DFG+DWIP) | 479.858391 | 481.966663 | 330.2653457 | 632.0318605 | 599.9444497 |

| DRM | 184.6718803 | 190.741664 | 151.9861635 | 168.7275916 | 162.8698169 |

| DWIP | 14.34510091 | 19.67328423 | 14.24752208 | 16.7276315 | 17.15874619 |

| DFG | 280.8414098 | 271.5517147 | 164.0316601 | 446.5766374 | 419.9158866 |

| Supply Chain Cost | 290.06 | 287.102 | 277.254 | 318.754 | 270.418 |

| Supply Chain inefficiency ratio | 0.059289329 | 0.050082161 | 0.056135655 | 0.075483145 | 0.08309049 |

| Supply chain working capital productivity | 5.09479823 | 10.57464352 | 5.570279811 | -24.93121974 | -33.2431052 |

| Supply chain working capital | 960.25 | 542.11 | 886.67 | -169.38 | -97.90 |

| Return on Assets % | 10.57 | 24.05 | 9.57 | 17.59 | 16.28 |

| Asset Turnover Ratio (%) | 56.83 | 74.07 | 53.39 | 77.66 | 82.44 |

| Fixed Assets | 1.12 | 1.57 | 1.47 | 2.67 | 2.53 |

| Inventory | 4.59 | 6.21 | 4.72 | 4.85 | 5.09 |

- Days of raw material is having variation may be there is a forecast issue and reliability issue with supplier. Days of work in progress is decreasing so manufacturing process is fast.

- Days of finished goods is time taken to sell the products it manufactures is less and good.

- Supply chain length is decreasing over the years and it is showing that company is eliminating unwanted costs.

- Supply Chain inefficiency ratio, since costs are reduced so supply chain inefficiency ratio is also reduced.

- Supply chain working capital productivity, liabilities are more than payable and inventory, using full power of credit.

- Supply chain working capital, is low because trade payables are more.

- Return on asset, is in downward trend which is something to be taken in to account.

- Inventory turnover is in the average of five days over the years.

SC challenges

- Lack of coordination

- Inventory management

- Demand information

- Human resource dependency

- Order management

- Shortage avoidance

- Expiration

- Warehouse management

Temperature control and Shipment visibility

The major supply chain challenge includes quality regulation issues, product proliferation, supply chain fragmentation and infrastructure gaps.

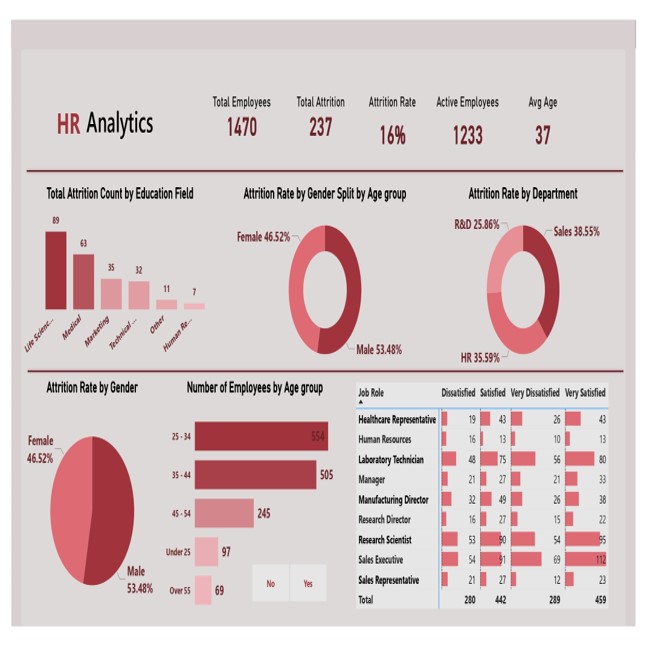

Comparative analysis of industry and study companies

Financial ratios

- Inventory turnover ratio:

Inventory turnover of the Torrent pharma is higher than Glenmark and industry. So, it which shows better utilization of inventory, that is, effective inventory management.

- Asset turnover ratio

Asset turnover of the torrent pharma tells that the company utilizes its assets more efficiently to generate revenue.

Supply chain ratios

- Supply chain inefficiency

Supply chain inefficiency ratio measures the relative efficiency of internal supply chain management. Comparing both the companies we can observe Glenmark is having better internal supply chain management.

- Supply chain working capital productivity

In terms of supply chain productivity, Glenmark shows better performance

- Supply chain length

Lower the supply chain length better the performance, Glenmark is having decreasing trend of supply chain length. So, Glenmark is performing well compared to Torrent pharma

SCOR model

Level 1: Defines scope and content of SC based on set target.

Leve 2: Company implement operation strategy and they choose supply chain.

Level 3: Ability to compete successfully in its chosen markets.

Figure: SCOR model of pharmaceutical industry (level)

Figure: Pharmaceutical industry value chain

Figure: Pharmaceutical industry supply chain

Figure: Pharmaceutical industry SCOR model.

As we can see the level 1 in SCOR model consists of plan, source, make, deliver and return, based on the value chain as shown in figure above. This process involves raw materials, supplier, manufacturer, distributer and consumer. In each stage source, manufacture and return is possible. Level one to three also includes schedule of product delivery, Return of material, Verification of product, transportation of product and authentication supply payment.

Source will have process of sourcing of infrastructure, vendor certification, component engineering, payment. Make will have process of manufacturing finished goods, resource, infrastructure and production. Delivery include warehouse management, client demand management, transportation, delivery infrastructure and order rules. Return include reverse flow of product and asset. In this SCOR model is used.

| Performance attributes | Strategic metrics | |

| Customer | Reliability | Right order, time quantity, requirements |

| Responsiveness | Consistent speed of providing product and services to customer | |

| Agility | Ability to respond changes in market | |

| Internal | Cost | Cost associated with managing and operating the supply chain |

| Assets | Effectiveness in managing supply chain asset in support of fulfillment |

SWOT

| STRENGTH Existing distribution and sales networks Barriers of market entry High growth rate High profitability and revenue | WEAKNESS Future profitability (Demand variablity)TaxesStrong competition from international and domestic giants means limited market share Stiff competition from many Indian and other global brands means limited market share growth |

| OPPORTUNITIES Stiff competition from many Indian and other global brands means limited market share growthLimited presence in emerging markets and European countriesIncreased investment in the budding markets, to push expansion in the global economyThey can leverage their acquisitions to further increase the growth | THREATS Increasing costsIncrease in labor costsConstant price risesThe Indian Rupee depreciated as compared to the US Dollar |

Key observations and recommendations

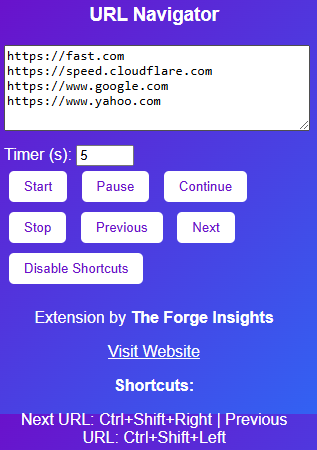

From above we know that Glenmark is performing well, though the Torrent pharma is catching up. Torrent pharma has to implement ERP tools to automate many of the stages in supply chain. The approval time is high in India. GST hit on pharmaceuticals is concern. Increasing cost of production, Demand variability of certain drugs are to be taken into consideration. International market entering in to market, weak intellectual property protection are also concern for manufacturer. Temperature control warehouse must be improved. The key performance indicators are Supply chain costs customer services and inventory levels as shown in the figure, focusing on these is important.

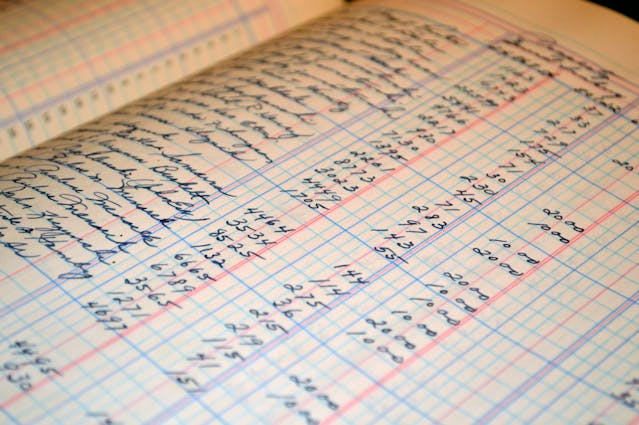

Lack of technological development is in the industry. As we can see in the image below the India is still catching the race in technology.

As mentioned earlier the supply chain is complex in India, reducing the complexity through the research and development, procurement, manufacturing and logistics and distribution will unlock new benefits.

Supply chain costs are higher in India which is to be reduced in order to deliver the best value to the service.

Compared to the best in class pharma industry Indian inventory moves slower, which is to be considered by manufacturers to reduce the lead time.

Conclusion

Indian Pharmaceutical companies are best utilizing and framing strong forecast strategies for export business. It is necessary to understand that the common inspection, filing procedures accepted among regions may help the industry in faster growth. India has cheap labor and high managerial and technical competence in emerging markets. Therefore, cost-efficiency continues to create opportunities for Indian companies in emerging markets. Indian Pharmaceutical sector expected to reach at 55% revenue generation till FY2020. The reason behind it could be The Government of India implemented ‘Pharma Vision 2020’ aimed at making India a global leader in end-to-end drug manufacture. Due to this the approval time for new facilities has been reduced to boost investments. Moreover, the Government of India is planning to set up an electronic platform to regulate online pharmacies under a new policy. This will lead to decrease the misuse due to easy availability. These are big opportunities for Indian Pharmaceutical market. As the GST sets in, pharmaceutical companies have to pay more in manufacturing cost as raw material cost has goes up by 7% and hence the MRP of the product need to be changed to absorb that impact. This is concern for manufacturers.

References

http://www.glenmarkpharma.com/Glenmark-Online-AR-2015-16/glenmark-at-glance.html

http://www.torrentpharma.com/indrad%20plant.php

http://www.moneycontrol.com/india/stockpricequote/pharmaceuticals/glenmarkpharma/GP08

http://profit.ndtv.com/stock/glenmark-pharmaceuticals-ltd_glenmark/reports